Life Insurance in and around Reading

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

State Farm understands your desire to help provide for your loved ones after you pass away. That's why we offer wonderful Life insurance coverage options and dependable reliable service to help you settle upon a policy that fits your needs.

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Agent Sean Reali, At Your Service

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you apply for should correspond with your current and future needs. Then you can consider the cost of a policy, which is calculated using your current age and your physical health. Other factors that may be considered include occupation and personal medical history. State Farm Agent Sean Reali can walk you through all these options and can help you determine what will work for you.

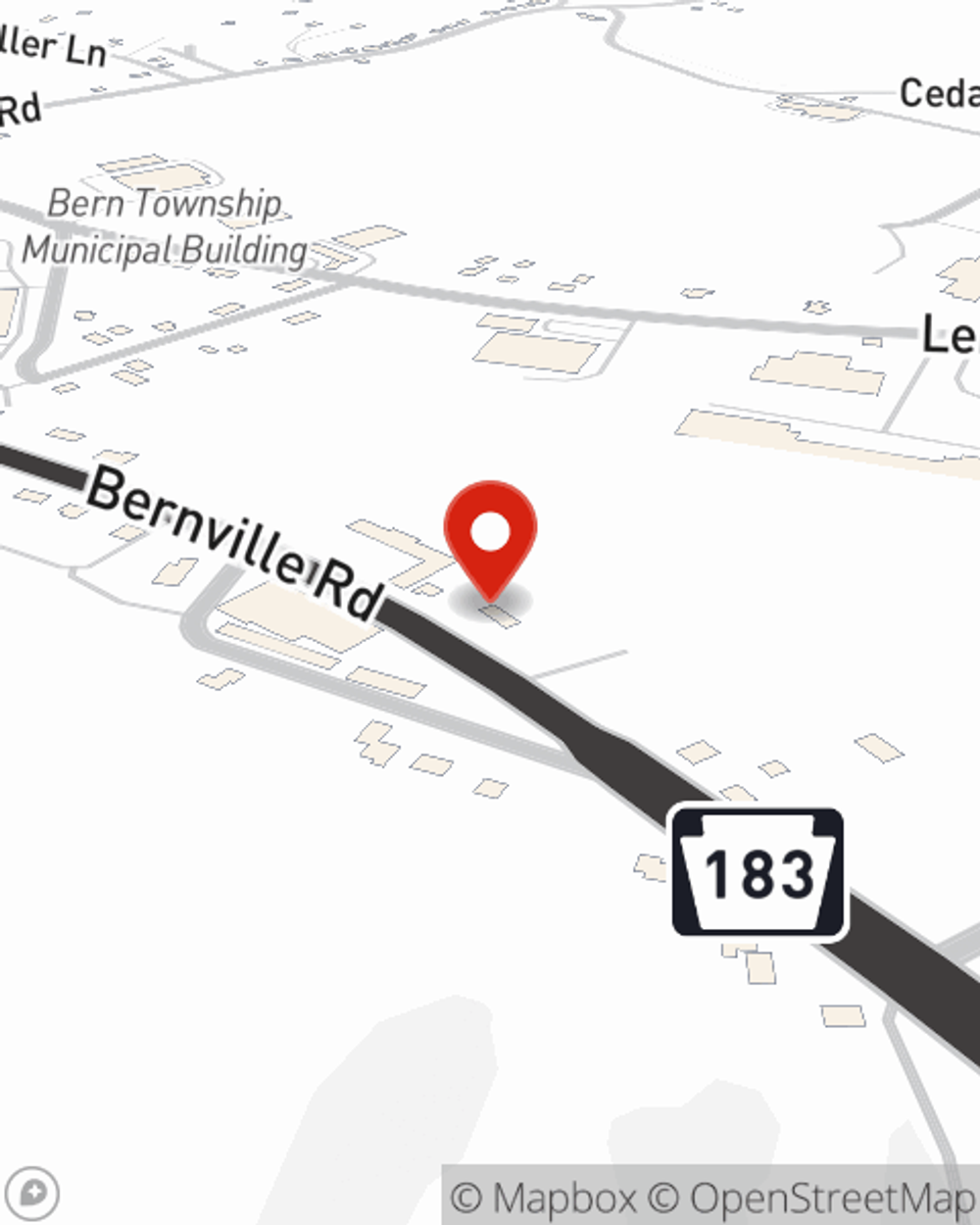

To check out how State Farm can help protect your loved ones, reach out to Sean Reali's office today!

Have More Questions About Life Insurance?

Call Sean at (610) 375-2600 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.