Business Insurance in and around Reading

Get your Reading business covered, right here!

Helping insure small businesses since 1935

Business Insurance At A Great Value!

Running a small business is hard work. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, specialized professions, contractors and more!

Get your Reading business covered, right here!

Helping insure small businesses since 1935

Surprisingly Great Insurance

Each business is unique and faces a different set of challenges. Whether you are growing a craft store or an auto parts shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your speciality, you may need more than just business property insurance. State Farm Agent Sean Reali can help with a surety or fidelity bond as well as life insurance for a group if there are 5 or more employees.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Sean Reali's office today to explore your options and get started!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

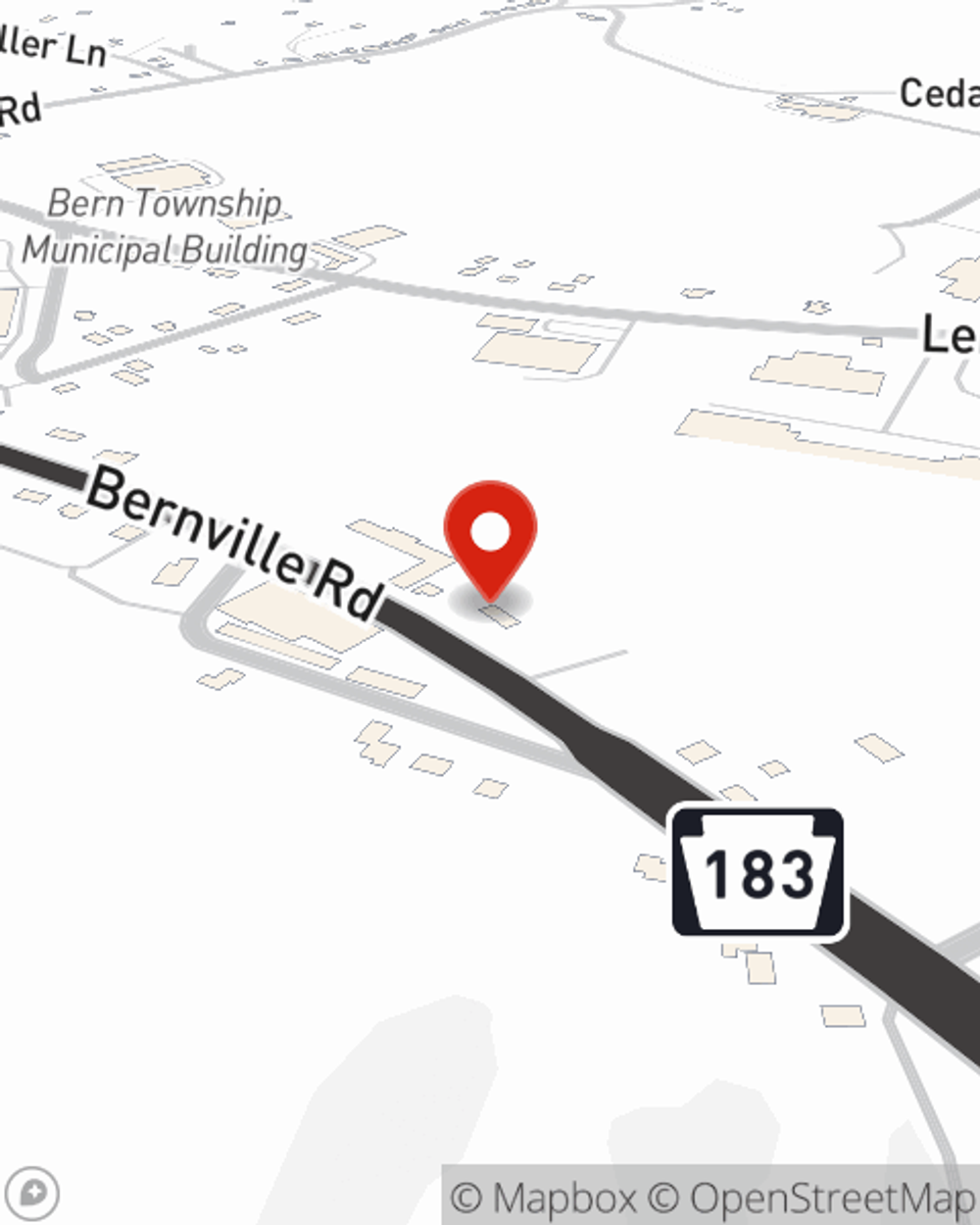

Sean Reali

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.